Investing in Equity fund is just like participating in Business. Investing in good businesses has always been the most rewarding investments in last 30 years. Equity Mutual funds invest in the basket of well researched good companies, for above average Long Term growth.

Safety : Every listed company can be bought or sold from the stock exchange. The current performance as well as future expected performance of the company, changes the market price of its stock in the exchange. Hence its market price keeps going up or down on daily basis. Despite volatility, good performance fetch a better price, always.

Liquidity : Just like any other open ended Mutual Fund Scheme, equity funds can also be redeemed anytime. Of course , one should check the exit load and tax impact, applicable at the time of redemption. If redeemed after 365 days, then all the gains from an equity fund will be treated under Capital Gain

Returns : Returns from an Equity fund depends upon the Risk you are taking ! There are multiple type of equity funds which can be chosen according to your Risk profile and suitability. There are equity funds with higher reward with High Risk , moderate reward with moderate Risk etc.

Given below is the list of such equity funds , ranked in the category of their Risk ( High to Low) :

Given below is the list of such equity funds , ranked in the category of their Risk ( High to Low) :

- Sector Funds

- Thematic Funds

- Small Cap Funds

- Mid Cap Funds

- Mid & Large Cap Funds

- Large Cap Funds

- Multi Cap Funds Funds

Check the power of Long term compounding

`

With an average ROI of per annum and

Will become

`

If you are investing for 3 years or more then must look at the benefits of investing in Debt MF. Debt MF offers better tax advantage, better returns and better liquidity over traditional Deposits.

Safety - Debt Funds have low credit Risk

Investing in Debt Mutual Funds are equally or more safe than any individual Fixed Deposits; but its daily NAV and interest sensitive price movement makes it fluctuate in its market value, sometimes. However if you are looking to invest in 3 or more years, such schemes offer better propositions .

Liquidity - Debt funds are highly liquid

Because of its Open Ended nature, units of such schemes can be redeemed anytime at the prevailing NAV. Generally such Debt funds have some exit load or charges if redeemed before 1 year or so. One should check exit charges before investing

Returns - Debt funds are better than bank FDs

It is said in every MF investment disclaimer, that past returns are not the guarantee for future performance. Still, historically if you check the returns of these schemes, you will find a performance better than traditional Fixed Deposits.

Comparison with FD for the same investment and tenure

Select Amount

1000

1 Crore

Select Year

03 Yr

10 Yrs

Debt MF Returns

` {{ debt_return_show }} ()*

FD Returns

` {{ fd_return_show }} ()*

Net Savings in Tax Payment (for not investing in FD) ` {{ diff_debtfd }}

Assumption :

# Rate of Return/Interest assumed @8% | # Minimum Time Duration is 3 Years | # Investor Under Highest Tax Bracket - 30%

# Debt MF will attract Cost Indexation benefit of @20%, so an investor will save tax outgo even if rate of return is same with Bank FD.

# Debt MF will attract Cost Indexation benefit of @20%, so an investor will save tax outgo even if rate of return is same with Bank FD.

It is advisable to keep your provisions for 5-6 months as an Emergency Fund in your savings account. What if you get better alternatives to keep such surplus? Look at these Liquid Fund Options.

Safety : Liquid Funds are also called a Money Market Funds as they invest in 1 day to 90 days securities available in the money market, like- T Bills, Commercial papers etc. Due to its nature of investing, such schemes do not fluctuate in their NAV unlike other Debt funds. Hence they are defined under a Low Risk category

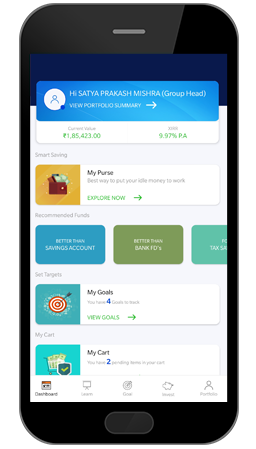

Liquidity : Such schemes offer instant Liquidity. Like, if you have invested in such scheme through our mobile application section – MYPURSE, then you can redeem it with money transferred in as quick as 2 minutes. In normal case of redemptions you will get the money back in 24 hrs.

Returns : As compared to a savings account returns, Liquid funds offer much better returns. You must check the return table once to compare on your own

How much should you have saved?

Start by estimating your costs for essential expenses

Monthly Expenses

Amount in Rs

Housing

Food

Health Care (including insurance)

Utilities (water, electricity, etc.)

Transportation

Personal Expenses

Debt Servicing (EMIs) & Investments (SIPs, etc.)

Total Monthly Expenses

Rs

You should have Rs. in any of the

‘Liquid Mutual Fund Scheme’ for your emergency requirements

‘Liquid Mutual Fund Scheme’ for your emergency requirements

Investing through SIP can be Highly Rewarding

What is SIP ?

Systematic Investment Plan (SIP) is a kind of investment scheme offered by mutual fund companies. Using SIP one can invest small amount peridically (weekly, monthly, quaterly) into a selected mutual fund. For retail investors, SIP offers a well disciplined and passive approach to investing, to create wealth in long term (using the power of compounding). Since, the amount is invested on regular intervals (usually on monthly basis), it also reduces the impact of market volatility.

Benefits of SIP

As common investor doesn’t have enough time and resources, SIP proves to be a viable option for them. Listed below are the important benefits of this instrument.

- Reduces Risk because of Rupee Cost Averaging

- SIP can be started with very small amount of money

- Timing the market is not necessary

- Long term financial goal can be aligned with SIP

- Disciplined approach towards Investment helps in controlling the emotions

Tax benefits

There are various mutual fund schemes which gives you better than saving account returns with the liquidity of savings account and even can be used to pay to network hospitals or can be used to pay directly to the merchant having the swipe machine.

- Liquidity - You can withdraw , increase or decrease your monthly SIP amount freely. All your gains will be Tax free if the units are redeemed after 365 days of its purchase

- Income tax benefit - Investments made in SIP schemes are eligible for deduction from taxable income under Section 80C of the Income Tax Act.

- Lower lock-in period - In comparison to traditional investment avenues like PPF, NSC under section 80C of the Income tax Act, mutual funds have the shortest lock in period of 1 years.

SIP Estimator

Use sliders to know the value of your Investment in MF Folios

Is there a better way to invest in a Tax saving Scheme- to save under Sec 80C ? Yes – ELSS ( Equity Linked Savings Scheme) offers so many advantage over traditional Tax Savings Schemes.

Safety : ELSS is a 3 year locked in product which invests all your money in a diversified equity basket. As compared to traditional Tax Saving Schemes, such funds do not offer any guaranteed returns, but are highly rewarding as compared to them. Those who understand the advantage of investing in Equities and are aware of its market risk, must choose ELSS as a Tax saving tool

Liquidity : Just like any tax saving schemes, ELSS is also locked in for a period. However its lock in period is much lesser than other traditional Tax Savings schemes. It is locked in for 3 years only and then it becomes a normal open ended diversified equity scheme.

Returns : You can check the scheme chart here and find yourself that ELSS has always been better rewarded in long terms , as compared to its other counter parts. So it is advisable to ignore the volatility part and go for an ELSS scheme to fulfil your Annual Tax savings requirements.

Check how much you can save

Select your investment amount

Depending on your tax-slab, your savings under Sec 80

{{ slab1 }}

If you are in 5% Slab

{{ slab2 }}

If you are in 20% Slab

{{ slab3 }}

If you are in 30% Slab

+919933919175

+919933919175